What are NFTs?

NFTs or Non-fungible tokens have been around for years but became extremely popular in 2021 and gathered considerable attention from traders, collectors, and beginners.

Even with all of the recent popularity, most people still don’t know what NFTs are or why they matter. Not sure what the difference is between NFTs and Bitcoin? In this article, we will cover some basics like what an NFT is and how they differ and compare to Bitcoin.

It all began with The Blockchain

When we discuss NFTs in this article, we are referring to non-fungible tokens that are on a Blockchain. The Bitcoin Blockchain and other Blockchains like Ethereum and Tezos really paved the way for NFTs to take off. Thus ushering in the dawn of digital property rights.

Now we can prove ownership of a token tied to a physical or digital asset and self-enforce the digital property rights without 3rd parties. Without decentralized Proof-of-work blockchains like Bitcoin or Proof-of-stake blockchains like Ethereum and others, NFTs just weren’t that important because ownership relied on a centralized database that a 3rd party company controls.

What are NFTs?

To keep it simple, Non-fungible tokens are digital tokens representing either physical or digital asset.

Usually this is a token on a blockchain like Bitcoin or Ethereum which has a reference pointer to a digital file like a jpeg, video, or audio file. The token which represents the actual ownership is always on a blockchain. The digital file might be hosted elsewhere like on AWS or IPFS. Some NFTs are fully on-chain including the digital file as this seems to be more and more of a growing trend. The first NFTs ever were on Bitcoin and Namecoin. Today most NFTs are on a variety of blockchains like Ethereum, Solana, Tezos, Flow, Binance Chain, Polygon and BSV.

Even though most NFTs represent ownership of digital assets, NFTs can also represent physical assets, like real estate, clothing, physical art, tickets, collectibles, etc. Over time, you will see more physical assets able to be digitally owned using NFTs.

Gaming will probably be one of the biggest sectors where NFTs will gain adoption. It’s already happening with popular blockchain games like

Axie Infinity and Aavegotchi.

Why do NFTs have value?

What makes an NFT valuable? There’s been a lot of hype around some of the prices people pay for NFTs. To keep it simple, NFTs are veblen goods. A veblen good is a good for which demand increases as the price increases, because of its exclusive nature and appeal as a status symbol. No different than any other high demand collectible, NFTs are becoming status symbols on social media where you can now use them to display your cultural literacy and provenance.

An avid non-fungible token (NFT) collector and Ethereum (ETH) holder has made history by spending a whopping USD 23 million worth of ETH on a CryptoPunk token — the highest fee ever forked out for an item in the so-called “OG” collection.

The item, CryptoPunk #5822, was sold on Saturday to Deepak Thapliyal, the head of a blockchain company named Chain.

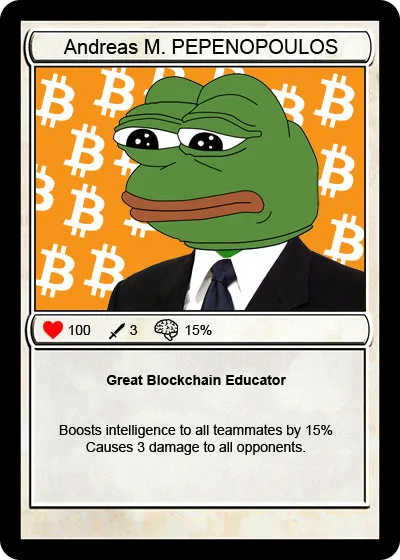

Highest sale of entire Sotheby’s NFT auction is this #RAREPEPE “PEPENOPOULOS” ending at $3,600,000.

NFTs are setting impressive sale records and although the majority of NFTs are in a slump and sales are down significantly, the top quality NFT projects are in high demand and still setting records every week.

What is Bitcoin?

For those of you who have been hiding under a rock for the last 10 years, Bitcoin (BTC) is the first decentralized cryptocurrency, introduced by the anonymous developer Satoshi Nakamoto in 2009.

Bitcoin isn’t physical, it’s digital. The way it’s designed allows anyone to self-custody bitcoin either online or offline without trusting a 3rd party. New bitcoins are mined on the blockchain using special computer equipment. Just like traditional money, Bitcoin and other cryptocurrencies are divisible and can be exchanged for one another without losing their value. Bitcoin can be purchased in different ways, including crypto exchanges as well as Bitcoin ATMs (check out the full list of our BitcoinATM locations), and stored in digital wallets.

After Bitcoin became popular it prompted the emergence of many new cryptocurrency copy cats, also known as alt-coins, short for Bitcoin alternatives. Many of the new crypto currencies claim to be “the next Bitcoin” or somehow improve what Bitcoin offers, but few have managed to compare in popularity, use cases, or adoption to BTC, as it remains the most liquid and valuable digital asset to date.

NFTs vs Bitcoin: What Are the Main Differences and Similarities Between Them?

Having summarized what Bitcoin and NFTs are, let’s now discuss what are the similarities and differences between the two.

Differences Between NFTs and Bitcoin

The main difference between NFTs vs Bitcoin is the fungibility. Unlike Bitcoin and other cryptocurrencies which can be traded for each other, non-fungible tokens, as their name suggests, are not as easily exchanged for one another. NFTs are unique and can’t be swapped for one another without consent between two parties. Trying to trade NFTs is somewhat comparable to bartering where you would try to trade 1 horse for 3 sheep. They are not fungible and contain unique characteristics, traits and rarity.

Another difference is the purpose behind Bitcoin and NFTs. It’s probably reasonable to say that Bitcoin’s main goal is to become a decentralized reserve asset that allows you to hedge against currency debasement, whereas NFTs aren’t used as a payment method but rather as collectible items or certification for ownership. Bitcoin is money whereas NFTs can represent collectibles, metaverse real-estate, music, etc. Both Bitcoin and NFTs can and are used as investments by investors who want to diversify their portfolios with new types of digital assets.

Similarities Between NFTs and Bitcoin

One similarity between Bitcoin and NFTs is that they can’t exist without Blockchain technology. Blockchain is what enables the self enforcing property rights of both of these digital assets. Some NFTs are literally stored on Bitcoin’s Blockchain via smart contract protocol called Counterparty. Another characteristic Bitcoin and NFTs share is volatility. Both NFTs and Bitcoin currently trade like speculative assets and their USD value can vary widely in price. Some NFTs are also priced in Bitcoin which can make things even more confusing if you’re measuring the NFT value in USD while purchasing the NFT with BTC.

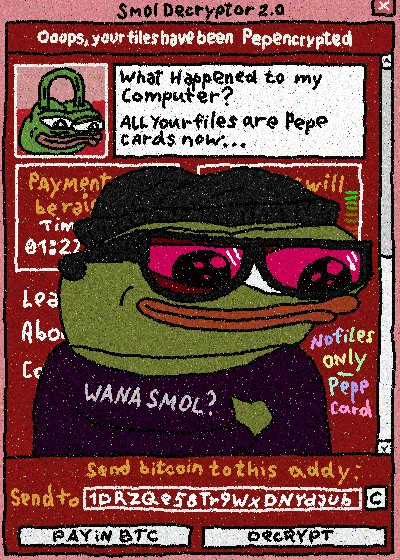

Bitcoin and NFTs can also be bought online using other cryptocurrencies or debit and credit cards. Bitstop also offers a fast and simple way to purchase Bitcoin through one of our many Bitcoin ATMs for cash. Once you purchase Bitcoin, you can use the Bitcoin to buy NFTs. Bitstop even had a NFT ATM at the Miami Bitcoin 2022 Conference which dispensed two limited edition cryptoart NFTs: The Bitstop Marketplace (pictured at the beginning of this blog post) and a Darkfarms special edition artwork RANSMOWLWARE! Maybe in the future, there will be many NFT ATMs in the world.

Both NFTs and Bitcoin are stored on a digital wallet. If you want to purchase them you’ll have to own a crypto wallet, either a cold wallet or a hot one, depending on your preference about where you want your private keys — the special code that is used to initiate transactions and only the wallet owner should know, to be stored.

Similarities Between NFTs and Bitcoin

As digital assets which rely on blockchain technology, NFT vs Bitcoin has several similar advantages and disadvantages. They include some of the following ones.

Pros of NFTs and Bitcoin

- Both types of assets are considered transparent and secure because of the technology they are using

- NFTs and Bitcoin are new decentralized assets that provide control to their owners and not a third party

- The data about the ownership of NFT vs Bitcoin can’t be altered once it’s recorded on the blockchain

- Both serve as a diversification to a traditional investor’s portfolio

Cons of NFTs and Bitcoin

- There are environmental concerns regarding the making of both bitcoins and NFTs although these concerns are usually overblown and FUD and baseless when you examine them closely

- Digital assets are volatile by nature which may result in frequent price fluctuations

- NFTs are relatively new and they still aren’t as popular as their traditional alternatives although they may become more popular over time

- 99% of NFTs will go to zero. Most of them are complete crap. The other 1% will most likely become extremely valuable over time.

Conclusion

Now you know that even though NFTs and Bitcoin both live on a blockchain and are speculative at the moment, they are very different types of digital assets. If their core difference should be summarized, it can be laid out like this — Bitcoin is fungible and its purpose is to serve as a decentralized cryptocurrency which serves as a currency debasement hedge, as opposed to NFTs which are unique and not nearly as fungible as bitcoin. They may also have additional collectible emotion value and even utility depending on the type of NFT. Even though they have underlying similarities, they are very different fro one another. Most will agree that Bitcoin and NFTs are going to change the world. Arguably, they already are.

Related Posts